Recession: A term that instills fear in the minds of the economists and the general masses. It brings in unemployment, reduced consumer spending power, a slowdown in business activities, sharp fall in the stock and real estate market, and all of these lead to a shrinkage in the overall gross domestic product (GDP). It is a widespread downward trend that continues for a sustained period resulting in negative growth. Financial crises become common and individuals and organizations suffer economic stress unless they are well-prepared to take advantage of the opportunities that are presented to them during this rough phase. And by well-prepared we mean actually being well-prepared.

Recessions are a part of the economic cycle, whenever economies reach their peak they can undergo a healthy negative trend or consolidation phase. But during this vulnerable phase, an extreme downward trend can get triggered through factors like external financial shocks, imbalance in supply and demand, major economic burners like wars, extreme resentments in employee unions, etc. These factors aren’t impossible to avoid but require daunting planning, arduous execution, and global collaboration. The global economy is a complex and volatile system, a global recession is considered when multiple major countries that hold a strong influence display contracting economies, and the overall growth of the world index turns weaker. On a global scale, it becomes more difficult to fight the demon.

Signs why we are heading towards a recession in 2024:

- Geopolitical Tensions and Trade Wars:

What can be a direct hit on a country’s economy? The country going to a war. There’s no other way around this. Geopolitical tensions and trade wars between the major players disrupt the entire global economy. And what are we seeing trending on social media right now? Prolonged conflicts demolishing economies and human lives, imposing penalties and trade restrictions, suffocating the supply, and burying down whole countries, all of these ensue in a big slowdown or a complete shutdown for a wide range of GDP contributors. There are adverse effects of these calamities that are felt miles away from the original participants resulting in a worldwide economic slump.

- Sluggish Growth:

One of the early signs of an imminent recession is a slowdown of global economic growth. The prolonged extension of the sluggish phase indicates an underlying issue in the economic structure. We are experiencing very stagnant growth in recent years across the globe with no major economic breakouts.

- Economic Fallout from COVID-19 Pandemic Recovery:

While the world continues to fight back against the COVID-19 pandemic, lingering economic consequences could persist in 2024. Supply chain disruptions, changes in consumer behavior, negative human psychology, and long-term impacts on various industries might continue to affect the global economic recovery. The possibility of the introduction of new variants or unexpected challenges in managing the ongoing pandemic could exacerbate these issues.

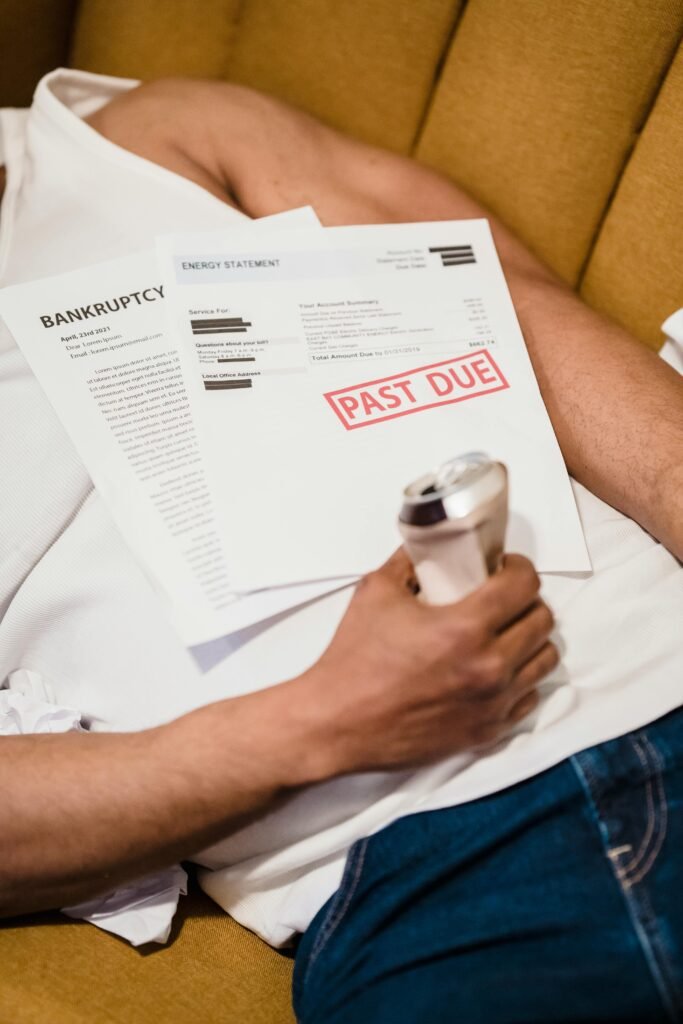

- Debt Traps:

High levels of personal and organizational debt in various countries can create financial vulnerabilities. While we are at the brink of the debt trap, a small bump in the interest rates or a loss of confidence in the ability to repay debts could lead to financial crises. It becomes more challenging for the government to fight back the recession through fiscal measures and people start losing hope creating a major depression.

- Rising Inflation:

Inflation, if left unchecked, can abrade the purchasing power of currencies and disrupt economic equilibrium. We are experiencing ballooning inflation and the global inflation rates might rise significantly in 2024. To keep inflation in check, the central banks may respond by tightening economic policies, leading to higher interest rates. Hoisted interest rates will result in increased debt pressure, affect general borrowing and spending, cause a general slowdown of the economy, and fuel a recession.

- Bursting of Asset Bubbles:

The stock market is near to its all-time high, and real estate is at its dreamy price. If any of these bubbles burst due to any sudden shock or change in investor sentiment, a change reaction will get started pulling the entire economy down.

- Major Job Displacement:

The working class is already feeling threatened by Artificial intelligence advancements. While technological evolution fuels the economy through innovation and increased productivity, it holds the potential of displacing traditional jobs. It becomes difficult to keep up with your job if the general mass doesn’t upskill them. Remember if you are feeling threatened in your role by A.I. then befriend it and start using it for your daily calendar activities.

- Environmental Shocks and Unforeseen Black Swan Events:

“Black Swan” refers to unpredictable and unknowable events that radiate major impact on the world. Impossible to anticipate, events like natural disasters, pandemics, or geopolitical shocks can result in an economic meltdown. Add the growing problem of climate change to this mix and we have a supervillain staring right back in our eyes. Global dispute, mishandling or negligence of these black swan events can propel the impact further.

Recession? 2024?

While the signs of a global recession happening in 2024 are causing genuine concerns, it is important to understand the actual outcome still depends on how the governments, businesses, and societies act to overcome these challenges. The global economy is resilient and adaptive, with proactive measures and mitigation plans, it holds the power to stay irrepressible. Potential threats can be alleviated through collaborative global efforts to implement sturdy economic policies. This will lay the foundation for the fiscal year and shape the economic landscape for the years to come. On a personal level, we recommend diversifying investments in multiple sectors, intelligently managing debt, subscribing to moneyscroll.com, responsible spending, and staying adaptable to technological advancements.