The financial world is changing greatly, mainly because of new technology. Every day, Americans have to deal with things like student loans, saving for retirement, and debt repayments. For them, there are several digital tools that use technology that are becoming important in helping them manage money. These tools provide features like budgeting and better investment methods. This makes it simpler for people to take charge of their money. As these tools improve, they can change the way we think about and handle our finances.

Smart Budgeting and Expense Tracking

Artificial intelligence is changing how people manage money by looking at their spending and making personalised budgets without effort. Unlike old budget apps that need you to enter things manually, AI tools automatically sort transactions, find regular expenses, and predict what you might spend in the future. They learn your spending habits, helping you tell the difference between normal purchases and occasional big buys. For busy people, this makes budgeting easier and less of a hassle.

Automated Bill Management and Payment Optimisation

Managing money well means handling expenses efficiently. With the right technology, you can easily see when bills are due, check your account balances, and set up automatic payments to avoid late fees and make sure your money is working for you. These tools also help you find better deals by comparing your spending with current market prices. This is especially helpful in the U.S., where many people often pay more because of complicated pricing.

Personalised Investment Strategies

New technology allows people to access advanced ways of managing investments. Systems can look at your risk level, goals, and market conditions to suggest investment plans tailored to you. Unlike basic robo-advisors that offer limited choices, modern tools can change your investment mix, manage taxes, and adjust strategies based on major life events like marriage, buying a home, or changing jobs. This new method provides high-quality investment management at a much lower cost than traditional financial advisors, especially when the market is unstable and people need help with retirement planning.

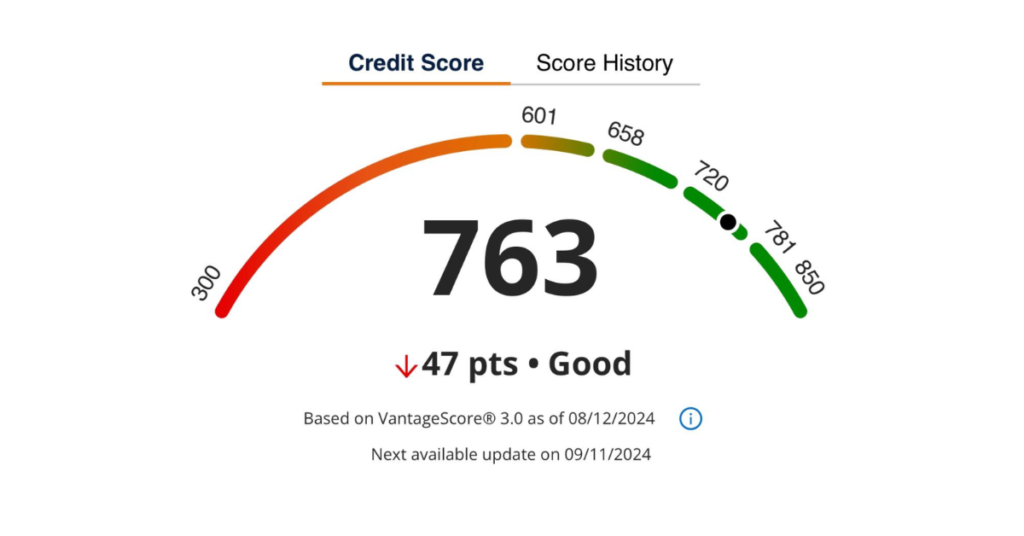

Credit Score Optimisation and Debt Management

Financial tools are getting better at helping Americans improve their credit scores and manage debt. These platforms look at your credit history, payment habits, and spending to give personalized advice on using credit wisely, making smart payments, and planning to pay off debts. They can also show how different actions might affect your credit score over time. Some services watch your credit in real-time, sending alerts if there are any changes or possible fraud, which helps protect an important part of your financial health.

Fraud Detection and Financial Security

As scams become more common, new technologies play a key role in protecting our money. Advanced data analysis can find unusual spending patterns, flag questionable transactions, and detect identity theft before it causes damage. For Americans who use digital payments and online banking more, these tools offer a strong layer of protection. They learn what your normal financial behavior is and let you know quickly if something is wrong. This proactive approach can save people a lot of money and avoid the stress of dealing with financial fraud.

Tax Planning and Preparation Automation

Tax preparation is shifting from an annual task to an ongoing process of improvement. New systems track financial transactions throughout the year, showing possible deductions and suggesting ways to reduce tax bills. With the growing complexity of U.S. tax laws, these tools help people understand the rules, stay compliant, and maximize tax refunds or minimize payments. Many of these platforms connect easily with popular tax software, making the entire process from tracking daily expenses to filing taxes more efficient.

Retirement and Long-Term Financial Planning

Technology has greatly improved long-term financial planning, especially for retirement. With factors like inflation, market changes, medical costs, and Social Security benefits in mind, these advanced programs can show how your financial future might look under different situations. They can also help you automatically adjust your investments and savings rates as you age to stay on track with your goals. With the challenges many Americans face in saving for retirement, these planning tools are essential for building a strong financial base for the future.

Integration with Banking and Financial Institutions

The growth of AI in managing finances focuses on its ability to work smoothly with existing banking systems. Many major banks and credit unions in the U.S. are working with fintech companies to include AI features in their services. This teamwork allows for real-time analysis of a person’s financial situation across all accounts, leading to more accurate suggestions and automated actions. With the trend of open banking growing in the U.S. AI will have more access to detailed financial data, greatly increasing its ability to offer useful insights and automation.

Conclusion

AI-powered financial tools are changing how people in the U.S. handle their money, but there is still a lot to learn about their full potential. As these technologies improve and become more accepted, they have the potential to improve financial well-being for more people. However, using AI in finance effectively involves choosing trustworthy tools, understanding their limits, and ensuring there is human supervision over automated processes. The future of personal finance doesn’t mean replacing human insight with technology. It means giving people smart tools that make managing money simpler, more accessible, and more effective.